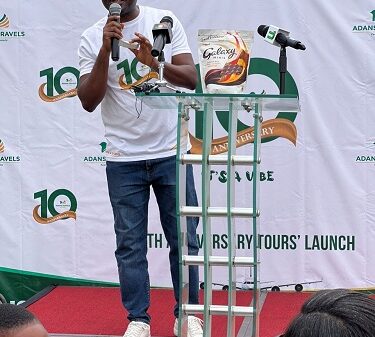

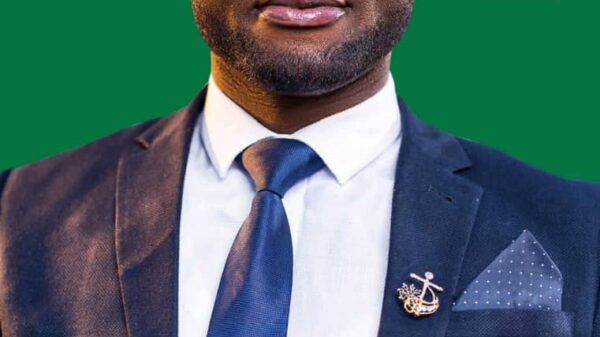

Prince Kofi Amoabeng, co-founder of the now-defunct UT Bank, claims he once bailed out Finance Minister Ken Ofori-Atta when his company ran into financial difficulties.

Kofi Amoabeng recounted in his book “the UT story: Humble Beginnings” how Ken Ofori-Atta approached him for a $5 million loan to keep his business afloat.

Because of their friendship, he felt obligated to give the money to Ken, despite the fact that it was above the Single Obligor Limit at the time.

UT was a non-bank financial service provider that was wreaking havoc on Ghana’s financial sector at the time with its superfast loans and debt recovery strategy.

Kofi Amoabeng then sought approval from his board of directors, who were vehemently opposed to the loan being granted.

Despite stiff opposition from his board members, he “literally stood surety for their application,” according to Kofi Amoabeng’s book, and the board reluctantly granted the application.

Things, however, did not turn out as he had hoped.

“Ken and his partner, Keli Gadzekpo, came to me bearing their shares in Enterprise Insurance as collateral for a loan of about ¢5 million.

“At the time, the cedi had undergone redenomination and had been rebranded as ‘new Ghana cedi’. The ¢5 million he requested, therefore, was equivalent to about $5 million,” he said.

“We were very good friends so I felt obliged, albeit not without conducting the necessary due diligence. It was curious though that they did not prefer the banks where they would have secured the loan at a much lower annual interest rate as compared to our significantly higher monthly compounded interest rates.

“Be that as it may after I perused their documents. I felt it was acceptable to grant the loan. The only snag, and a significant one at that, was that the amount exceeded the Single Obligor Limit. Ideally, I should have declined their request there and then. Instead, I decided to bail them out,” he said.

“Unfortunately, Ken failed to honour his end of the bargain. He defaulted badly on the repayment schedule. The situation was so bad that they could only service the interest on the loan,” he revealed.

“I became concerned because I had assured the board I knew Ken very well and I was convinced beyond doubt that he would honour his word. Thus I had egg on my face, especially as my partner had expressly stated his disapproval of the request,” he said.